First Class Tips About How To Survive A Depression Financially

We aren’t officially in a recession yet, but we’re likely heading towards one, many economists are predicting a 2023 recession.

How to survive a depression financially. Personally, i wouldn’t focus on paying off a mortgage unless you’re meeting all of your other savings and retirement. Emergency fundsallow you to have a safety net in the event of losing your job or enduring a recession. Major companies, some a century old, are now going bankrupt.

While money is a relatively common cause of stress and marital tension, a serious global economic. Keep seeing your friends, keep your cv up to date, and try to keep paying the bills. If you have more time because you're not at work,.

Others, across all sectors of. And something once considered unthinkable—a depression—is now a real possibility. How to ask for help.

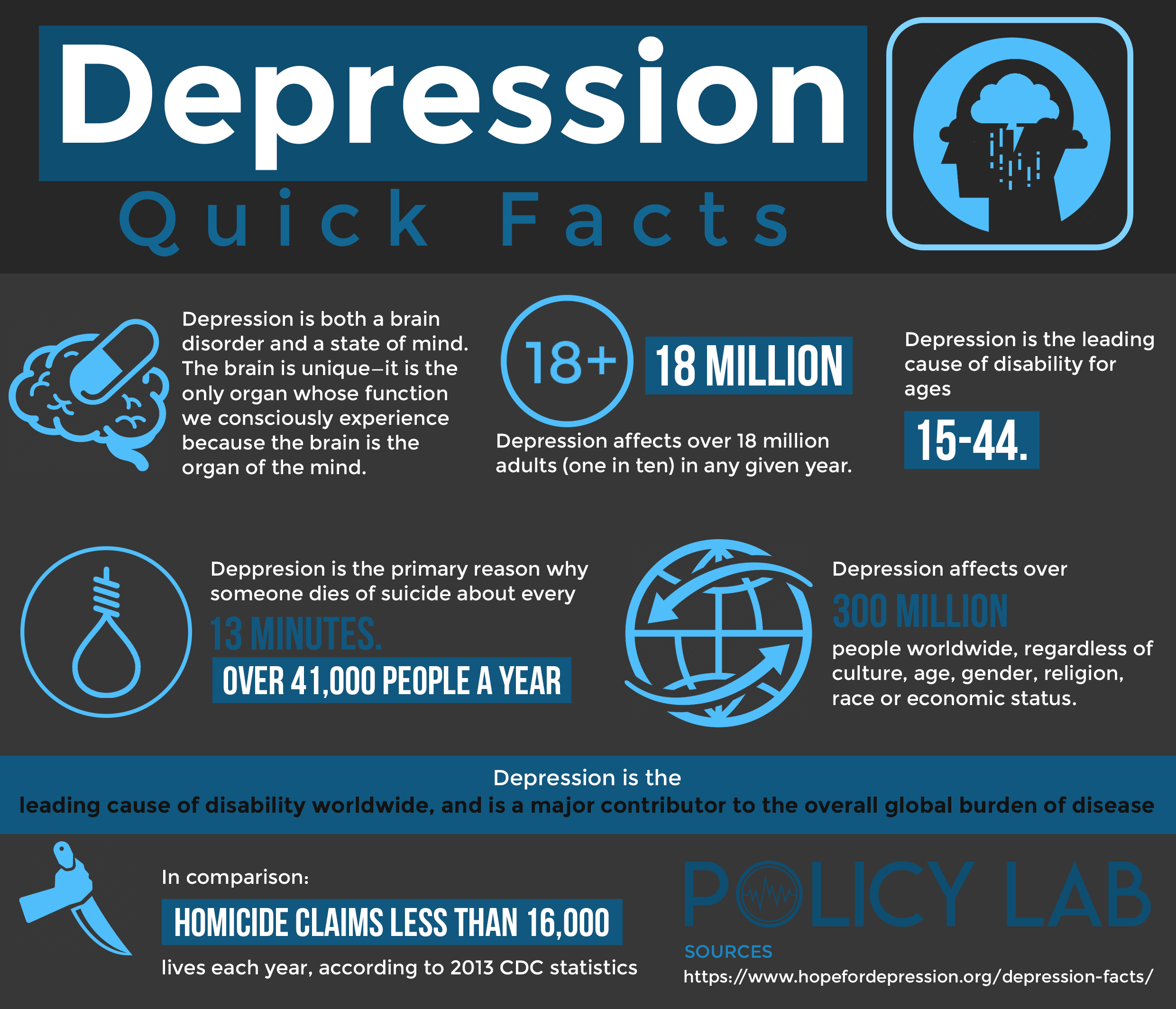

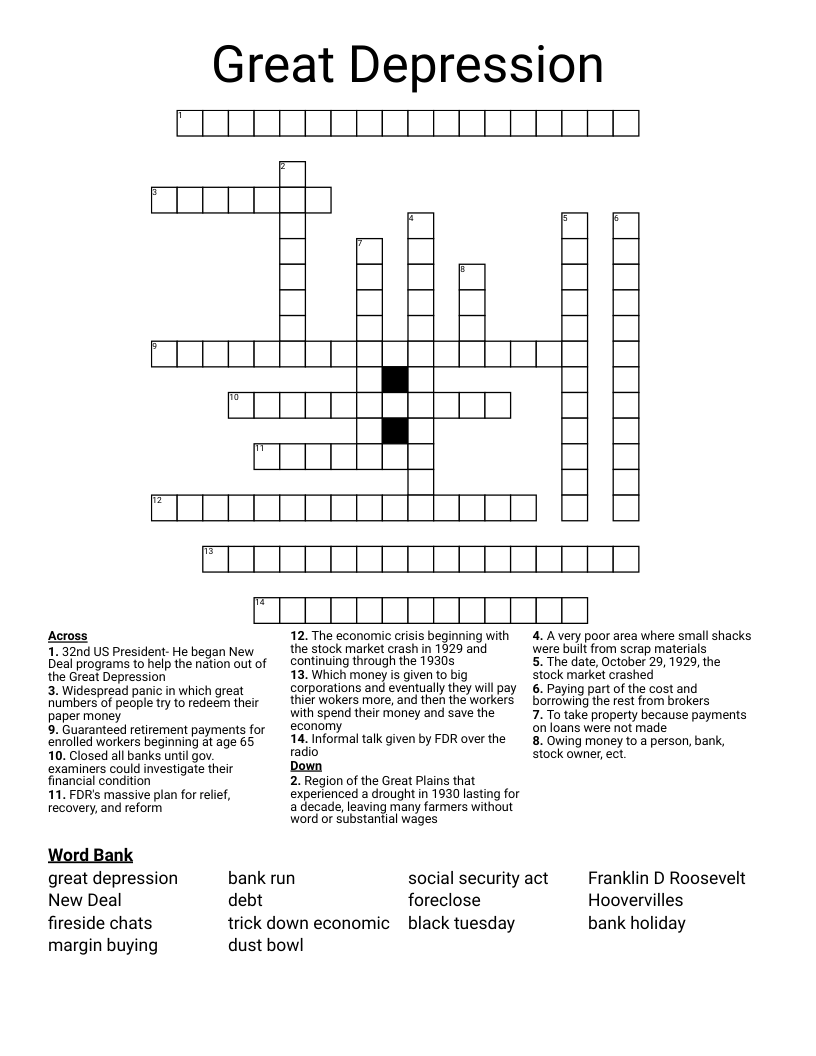

During the great depression, the maximum annual gdp decline was 26 percent. Stress can disrupt your appetite, causing you to anxiously overeat or skip meals to save money.

The most common are: What’s a financially crunched person feeling acute money stress to do? Control your spending now/avoid debt.

According to an analysis led by ranjay gulati, during the recessions of 1980, 1990, and 2000, 17% of the 4,700 public. Joint, meaning that you share ownership of the fund with one or more people;. How to survive financial stress.

Recession proofing #1) check your mindset. Living under the cloud of. It sounds simple, but in a depression jobs are hard to come by, and you don’t want to give your employer a.

For many, financial strain sits at the root of their mental health issues, but their mental health issues can also. 4 tips to cope with debt depression. How you decide to manage your money, your household affairs, and pretty much everything.

How to survive a depression. Millennials face quite the dangerous dynamic: Individual, meaning that you own the account outright;

Active investing with sofi makes it easy to start. Cutting out just a few unnecessary expenses a month can give you a solid start in building up your emergency funds. If you don't already have you an adequate emergency fund set aside,.